What’s Next?

What’s Next?

November 27, 2012 by Lesjak Planning

The elections are now over with the president winning with 3% more of the popular vote than the challenger. The House of Representatives keep their Republican majority and the Senate keeps their Democratic majority. Voters have opted to keep this split in power and it should be a clear message to our elected leaders to put aside their strict adherence to party lines, compromise and make the tough decisions that will be needed very soon to get our economy growing again.

There continues to be cause for concern looking forward for investors. Our “Fiscal Cliff” here at home which will have mandatory spending cuts and tax increases implemented on January 1st, Europe’s continuing debt crisis, and most recently, the conflict in the Middle East has investors on edge once more. Taxes, the budget deficit and the implementation of healthcare reform continue to have businesses stuck on the sidelines waiting for some clarity so long term spending and hiring plans can be made. In general, the investing markets do not like uncertainty and at the present time there is plenty of it.

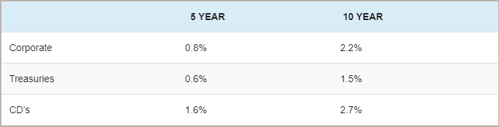

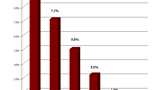

This year to date, the equity markets have rewarded those investors who have participated with returns of 14.3% for the S & P 500 Index and 12.3% for the International Index. So far in this current quarter, nearly 60% of all companies reporting have beaten their earnings estimates. Surprisingly, financial stocks have had the best returns with a gain of 22% to date. Corporate bonds are up 4% to date and government bonds are up 2.1% to date. At present, the yields on various bonds are:

We as investors, not traders, must remember why we invest. We make long term goals that span many years and decades. Economies go through stages of growth and stagnation that often are not identified until they have passed. What happens during a trader’s investing timeframe of months, weeks, or even days, has in the past had no bearing on market’s overall performance over time. While we must acknowledge these ups and down trends as they occur and make some adjustments accordingly, we should not lose sight of our long term goals and the reason we invest.

Continued communication during uncertain times is key to monitor accounts and address uncertainties and questions. Strategies and the adoption of new ones keeps you well balanced and positioned to take advantage of new opportunities while also maintaining a risk level that is suitable for your needs.

We feel confident now that elections are over, that our leaders will realize this country comes first and work together somehow to make the decisions that need to be made to get us moving forward as a united nation once again.

Current yields on dividend paying stocks are rising since corporations are paying dividends or buying back shares with the excess cash they have socked away

These yields range in the 4%-7% area with some much higher. Inflation is expected to stay at 2%-2.5%, at least for the short term. Higher taxes, whether from income, investments, sales tax, etc. will also have an effect on net investment gains.

If an investor gets spooked by all of the negative goings on in the world and moves to all cash or fixed income vehicles, then a net loss is virtually guaranteed after inflation and taxes. This reduces the purchasing power of each dollar year after year. The investor who concentrates on the currently healthy earnings and strong cash position of corporations and buys their stock without regard to negative possibilities takes the risk of volatile declines that can occur.

An investor also has the option of trying to go “all-safe” during times of uncertainty, and then going “all-in” to equities when the skies clear. In our 30 plus years in this business, we have yet to meet, let alone hear of anyone who has been successful in making the timing of the “all-in” and “all-out” calls in any consistent fashion. As newer research technology and faster trading become common, the already miniscule odds of success in making successful timing moves decrease dramatically.

About the author

Lesjak Planning