October 29, 2018 Lesjak Planning Perspective

October 29, 2018 Lesjak Planning Perspective

October 29, 2018 by Lesjak Planning

The term “climbing a wall of worry” has been used for decades to describe how stock markets continue to rise in value as negative events, both domestic and worldwide, dominate the news. This seems to be the case this year as negative news monopolizes our daily lives including: tariff threats with our international trading partners, polarized political infighting here at home, Brexit struggling again, and recently immigration issues. Equity markets have run up to new highs right into October.

The current market is not cheap by historical measures, but it also is not at extremes seen at prior market tops. Our economy is growing as evidenced by current GDP for the third quarter at 3.5%, corporate revenues and earnings are growing and are projected to grow at double digit rates through 2019. Indicators such as the Advancing stocks versus Declining stocks line has been positive, transportation stocks have followed right along with industrials, and smaller companies continue to do well. This is not historically the case at market tops.

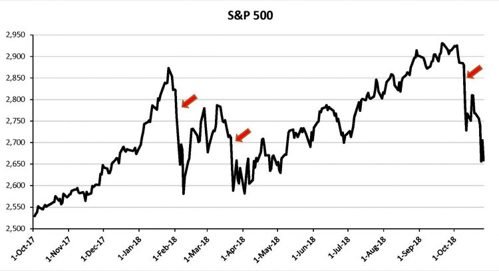

The chart below illustrates the three sharp declines in the S&P 500 index over the past year. As technology and trading techniques expand, market moves are becoming much more volatile and extreme which only adds to the fear and anxiety of non-professional investors. Professional traders today use very sophisticated computer programs that use mathematical algorithms to find and exploit not only daily pricing opportunities, but down to the hour or minute. These techniques are automatic and trade millions of shares very quickly and for very short periods to make profits and exploit the fear and greed emotions of novice investors. You only need to look at recent price swings to validate this. Amazon price last week gained about 7% in the hours leading up to their earnings announcement. Within minutes after they reported that they missed projections the stock price declined over 7%. Netflix is another example of their price rising over 12% upon a good earnings report, only getting hammered the next day by computer trading. These short term techniques, although they encourage the emotional anxiety of investors, rarely change the overall direction of the markets.

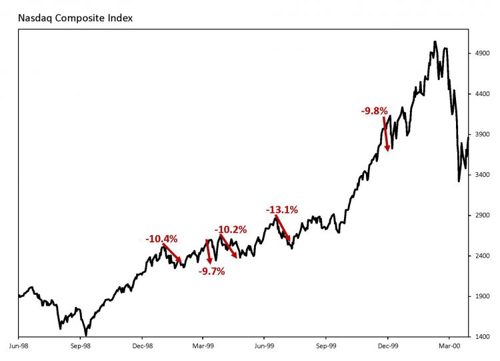

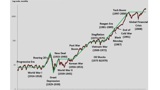

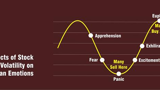

As mentioned prior, this market run has lasted quite a while and has been pretty calm. Although data indicates we should have more upside ahead, volatility will continue to test emotions going forward. The chart below illustrates how volatility becomes more prevalent as bull markets age. Since there is no one person that can call the exact end or beginning to the various cycles in investing, we suggest sticking to your investment plan and allocating assets across various market sectors depending on the risk one can assume.

Then something changed.

During the most recent corporate earnings reports, revenues and earnings for the majority continued to either beat or exceed projections. The difference this time was that future earnings projected by these companies were cautious due to the unknown effect that a prolonged trade dispute with China will have on their profits. Tack on to that news that the Federal Reserve reiterated their intent to continue to raise interest rates through 2019, thereby making loans more costly for business to expand. And then finally, the midterm elections are imminent. The wall of worry just got taller.

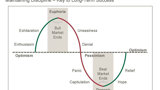

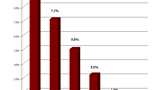

U.S. equities have experienced a very profitable, mostly uninterrupted run for the last ten years. These multi-year periods of gains have occurred in the past and historically don’t end when caution and pessimism abound regarding stock prices and the economy. Current data shows 28% of investors are bullish on the market versus the historical norm of 38%. Those that are bearish number 41% currently versus historical 30%. Bull markets have not ended when investor fears are at extremes as they are right now and volatility is high. This fear hit highs not only now, but also in February of this year. Bull markets end when investors are cheerful and optimistic that the rise will never end and when cocktail party conversation is about hot stocks and doctors quitting their practices to day trade stocks.

About the author

Lesjak Planning