Round Two of the Cleanup

Round Two of the Cleanup

September 17, 2008 by Lesjak Planning

For the second time this decade, a major cleanup of corporate mismanagement and greed is in the works. In 2002, it was the accounting scandals that destroyed household names like Arthur Anderson and Enron. Today the mismanagement of risk and the allure of short-term gains has taken the 158 year old Lehman Brothers firm, Merrill Lynch, and possibly AIG Insurance Company.

On a second note: Concerns over the stability of Charles Schwab and TD Ameritrade as custodians of accounts should be put to ease. Neither has any exposure to the subprime mortgage market and in addition to the Securities Investor Protection Corporation’s coverage of $500,000 per investor account, both have additional coverage of $150 million per account should they fail. Furthermore, the Schwab and TD Ameritrade money market funds do not have any exposure to any Lehman Brothers securities.

We are very confident that the underlying strengths of the overall market will get us through this latest round and reward those with the diligence to stay with those strengths. Please feel free to discuss this or any concerns you have by giving us a call.

The reality of these types of cleanups is that it will take some pain and some failures to correct the problems and make the system stronger for the future

The good news is that this is medicine that needs to be taken to move forward.

We feel that once we get through this round the markets will be in position to get back to business. As in every other major decline in the past, valuations of companies become oversold and very attractive. A better corporate and credit climate will allow the equity markets to resume their climb to historical new highs.

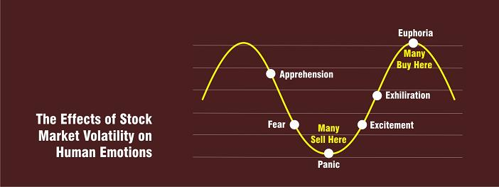

In our last newsletter, we illustrated the effects the markets have on investors’ emotions. We may very well be in the panic phase and we know what typically follows that. Sticking with your allocations during these times has historically rewarded investors. The fixed income and bonds in your allocations are doing their job of preservation during these times.

About the author

Lesjak Planning