March 26, 2015 Perspective

March 26, 2015 Perspective

March 26, 2015 by Lesjak Planning

The volatility in the equity markets continues to be present as we alluded to in our February Comment. What is interesting is that this year to date, the leading sectors have flip-flopped from those of the last quarter of 2014. Small and Mid Cap firms are beating the Large Cap stocks at this writing about 6% compared to 2% year to date. The stronger dollar is affecting the exports of the large multinational firms and hurting their bottom line. The smaller companies are not as much affected since most of their sales are in the U.S.

International funds have been helped by the decision of European leaders to unleash their own version of our Quantitative Easing (QE) and lowering interest rates to jump start their economies. The International managers have rebounded nicely from 2014 lows and are nearing many all-time highs.

We stated in our December Comment that no one knows when and which sector will outperform. In one of Warren Buffett’s letters to shareholders he also stated: “An investor will succeed by coupling good business judgement with an ability to insulate his thoughts and behavior from the super-contagious emotions that swirl about the marketplace. Patience is the rarest commodity on Wall Street.”

Since active managers are not required to stay invested during the down market years and have the ability to purchase shares in beaten down companies when bear markets occur, the overall performance has been significantly better while reducing risk on the downside. The observation one can make is that after six years of market gains and the probability of another correction occurring sooner rather than later, is that investors are moving in the wrong direction at the wrong time.

We expend considerable time and resources on a continuing basis to find and vet the best managers in each investment sector across the globe and match them in specific portfolio allocations to meet the individual needs of clients. They are referred to as the best of the best.

Happy Easter!

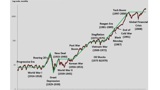

Playing right into the discussion of being patient investors is the phenomenon that occurs in every market cycle we have experienced.

During the rebound phase, or the straight up growth phase after a severe market decline, the talk from the unmanaged market index funds suggest that since the index funds outperform the vast majority of active portfolio managers you should just index your portfolio and forget it. Numerous articles in money magazines jump on this bandwagon and the flow of funds data suggest that investors are doing just that. Last year people yanked $98 billion out of actively managed funds in the U.S. while putting $71 billion more into passive ones that merely track an index.

A Market Watch December 2014 article reports that using the time frames of 15 and 10 years both ending 12/31/2013 found that the S & P 500 Index outperformed 80% and 63% of its peers over the two time periods. However, during the two down market cycles the index beat only 34% and 38% of its active management competitors. And this is against ALL of the U.S. equity funds of which there are thousands. Its record is much more negative against the 30-40 selected active managers that we use.

About the author

Lesjak Planning