Behind the Scenes

Behind the Scenes

February 13, 2009 by Lesjak Planning

Are The Markets Forming a Bottom?

This seems to be the question of the day and one we will attempt to answer. With the major news focusing on the economic numbers and congressional actions of stimulus packages and bailouts, we will update you on some technical information.

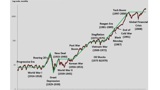

In every major market decline of more than 50% in the past, the bottoming process has had commonalities. After the decline to the actual low point, there is a rally of more than 20% that lasts for a few weeks. The old low point then is re-tested within a short period thereafter. This is the point where most investors give up on the stock market and lose interest. It is after this successful re-test of the actual low point, and loss of interest by investors, that values begin to increase. In all previous declines of this magnitude, the following year or two has produced very impressive gains.

The current market decline is setting up almost identical. Last November 20th the S&P 500 Index closed at the low-to-date value of 752, which was 51% lower than its peak in October 2007. A failed short term rally of over 24% took us to the end of December. A re-test of the November low was reached January 20th at the S&P 500 Index value of 805. It remains to be seen if this is the final re-test of the lows. After the past week of volatility associated with the stimulus package, the S&P 500 Index stands at 835.

Money Managers Gain Recognition for 2008

At LPC, our research into investment strategies and philosophies has resulted in a list of hand-picked money managers we use for your portfolios. While even the best may have a down year, it is always nice to see managers we use being recognized for their performance. This past year was no exception as we had managers nominated for Morningstar’s Money Manager of The Year in all three categories.

Domestic Stock

- Fairholme Fund (Bruce Berkowitz)

- Oakmark Equity Income (Clyde MacGregor & Ed Studzinski)

- Osterweis Fund (John Osterweis)

International Stock

- First Eagle Overseas (Jean-Marie Eveillard)

- Thornburg International Value (William Fries & team)

Fixed Income

- Harbor Bond (Bill Gross)

- Pimco Total Return (Bill Gross)

- FPA New Income (Bob Rodriguez)*

Bob Rodriguez of FPA New Income was named the Morningstar 2008 Fixed Income Manager of The Year. During a year when credit markets were as unforgiving as the equities, Rodriguez successfully executed his main goal of protecting principal while notching his 25th consecutive year of positive returns. We will continue to apply our knowledge, experience, and long term investment philosophies towards selecting the money managers that are best for your portfolios.

2008 Tax Loss Reminder

While a market downturn is never a welcome sight, it does provide opportunities with regards to your tax planning. We were able to realize short-term and/or long-term tax losses for many of our clients this past year. Be sure to include those figures in the preparation of your 2008 tax returns. Keep in mind, any excess losses can be carried forward for future years. Please give us a call with any questions or if you need additional information.

Best wishes from all of us!

We also note many other positives.

Selling pressure is much less than a couple months ago. Declining volume on down market days has reduced substantially and increasing volume on positive days occurs more often. While unemployment numbers are still high, we expect a leveling off in numbers this quarter. Unfortunately, layoffs have always occurred in the normal business cycles of expansion to contraction and then back to expansion again. In the past few days, retail sales have risen unexpectedly and home foreclosures have reduced. Cash on the sidelines has increased to over $9 trillion of which a large part should make its way back into equities eventually. Much of this cash is in 0% treasuries or 1% savings accounts.

This correction will eventually end, and is looking to be following the pattern of previous declines. We are optimistic of the outcome and are looking at these levels as being attractive for purchases of quality companies for the future.

About the author

Lesjak Planning