December 29, 2014 Perspective

December 29, 2014 Perspective

December 29, 2014 by Lesjak Planning

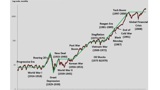

This year has provided many wake-up calls to those that think they know in advance what will happen in the investing markets. Trying to time highs and lows is a lesson in futility.

Going into the new year of 2014, the general consensus was that interest rates had to rise since the economy would begin to grow and inflation would again raise its head. If the Federal Reserve raised rates, long term bonds would get crushed and it would be unclear how the equity markets would react. As of this writing, interest rates have actually decreased and many fixed income investments have almost equaled the Dow Jones Industrial return of 9%. It has been a stellar year for Transportation and Utility stocks, up 23% and 25% respectively. Small company stocks began their decline in the summer and fell hard during the October decline. They have rebounded but trail their larger counterparts with a gain of 4% year to date. International markets have struggled for the majority of the year and have declined an average of 5%. Prices of commodities including corn and soybeans have fallen through the floor due to a perfect growing season that produced record yields. Gold and Silver prices continued their multi-year decline.

Oil has dominated the news since summer due to its drop from $115 per barrel down to its current price in the $50’s. This is a dramatic drop that has consequences across many fronts. A major positive is the additional cash that consumers have in their pockets. This money can be saved or spent on other items that may not have been afforded before. Another plus, at least to us, is that Russia, Iran and Venezuela are taking a huge hit to their abilities to spend their cash from oil profits on projects that are detrimental to the US and world peace.

The loss of purchasing power is a major concern going into the future. Due to the ever-increasing life expectancy and the unknowns of medical costs, inflation and taxes in the future, we must continue to work diligently to construct portfolios that give us the best chance of meeting those needs.

Happy Holidays!

Here at home the decline in oil prices will most likely cause the demise of the weaker companies involved in the growing business of drilling, recovering, and transporting our newfound abundance of oil.

The OPEC nations have repeatedly refused to limit production to stabilize prices as they have done in the past. There are theories that OPEC wants to limit their neighbors (Russia and Iran) ability to continue funding projects that are a threat to them. Another theory is that OPEC is trying to put companies in the U.S. that are using the new technologies to find and extract oil out of business. The U.S. has almost doubled the volume of oil and natural gas it produces over the last few years. That is a direct threat to OPEC.

2015 will surely bring its own problems and opportunities as we trudge our way through it. We need to remember that no one knows what is coming next and not everyone’s goal is to see how much money they can make each year. Appetite for risk and where you are in your investing life plays a major part in the process of determining where and to what extent you place your money for growth. The volatility of markets when watched day to day, week to week, or month to month can be quite maddening and cause the novice to freeze from fear.

About the author

Lesjak Planning